A Wild Ride

By Theresa Gusman, Chief Investment Officer | Download the PDF

Overview

- It’s been a wild ride – and like the terminus of a dizzying, high-speed roller coaster, we’re right back where we started.

- After hitting an all-time high in mid-February, plunging 34% from its peak, bouncing in late March, and advancing 20.5% in the second quarter, the S&P 500 is down less than 2% year-to-date.

- The Consumer Discretionary, Technology, and Energy Sectors performed best in the second quarter, and the Utilities, Consumer Staples, and Financials were the worst performers as investors’ risk appetite returned.

- The growth versus value chasm continued to widen in the second quarter, which is not surprising given the increase in risk appetite and sector performance in the second quarter.

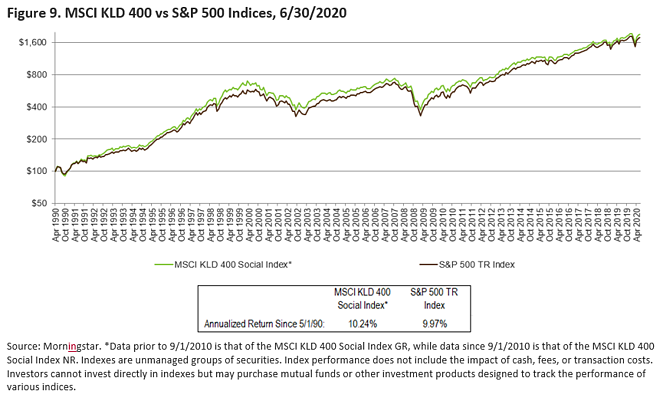

Strategies incorporating environmental, social, and governance (ESG) factors broadly outperformed traditional strategies and indices in the second quarter as the emphasis continued to shift to quality and sustainability. - Uncertainty surrounding the COVID-19 led to a sharp rise in volatility in March, which continued through the – albeit to a lesser extent and to the upside (which always feels better).

- Attention remains focused on the trade-offs among rising COVID-19 cases, quarantine-fatigue, progressively easing the shutdown that crippled the global economy, and “whatever it takes” monetary and fiscal policies. The effort to weigh conflicting and potentially disastrous outcomes – both personally and collectively – sets the backdrop for continued market volatility and unpredictability in the coming month

Second Quarter Market Review

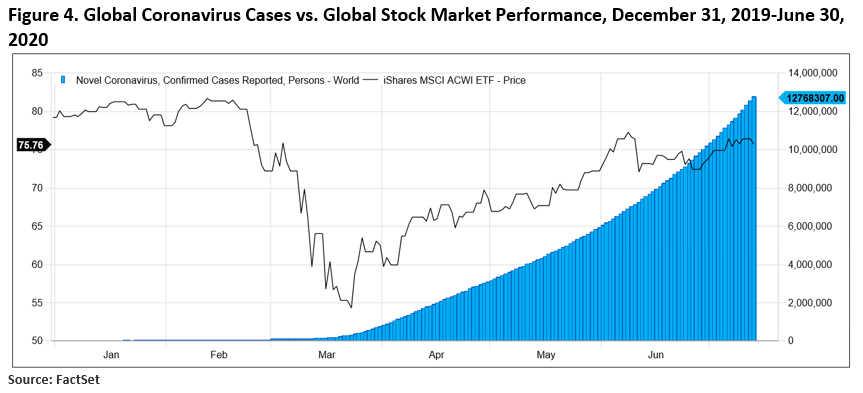

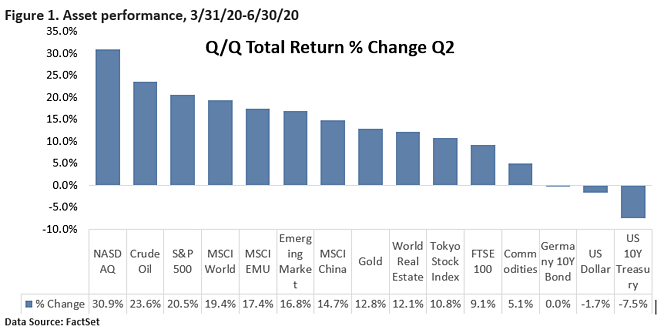

Investors’ risk appetite returned in the second quarter, resulting in sharp gains across most global markets following massive coronavirus-fueled losses in the first quarter (see Figure 1). As noted by RBC, “the fastest 30% drawdown in the history of global equities in the first quarter was followed by the largest 50-day advance in market history in the second quarter. The S&P 500® was back above 3,100 on June 3 and the Nasdaq hit a record high on June 10. Meanwhile, commentators have been lining up to claim that markets are detached from fundamentals.”1

A few second quarter highlights:

- Amid the gains, market volatility has increased. According to Morningstar, the S&P 500 Index posted +/-4% moves in 17 trading days through mid-June of this year versus an annual average of just 3.2 days from 1928-2019. Even a the 10Y US a Treasury – a former bastion of stability – increased 9.14% in the first quarter and fell by 7.5% in the most recent period (see Figure 1).

- As reported by Morningstar, US Small, Mid-Cap, and Large Growth funds surged 32.2%, 30.3%, and 27.4% in the second quarter – continuing their multi-year surge relative to lagging value strategies. Large and Mid-Cap Growth funds are now up 7.8% and 3.7% YTD. By comparison, US Large Value advanced by 15.7% in the second quarter – rendering it the worst-performing US fund category – and is now down 15.2% YTD.

- The Consumer Discretionary (+32.9%), Technology (+30.5%), and in a reversal from the 1Q, Energy (+30.5%) sectors performed best in the second quarter, and the Utilities (+2.7%), Consumer Staples (+8.1%), and Financials (+12.2%) sectors performed worst.

- Non-US markets remain mixed and for the most part continue to underperform the US

Outlook – “Don’t fight the Fed” but be prepared for volatility

Perhaps markets have become detached from fundamentals – which is reflected in recent the declines in projected earnings and high forward PEs discussed below. However, earnings estimate cuts and PE blow outs are typical as economic growth bottoms, plus we subscribe to the adage, “don’t fight the Fed”. Monetary – and fiscal policies worldwide – have been focused singularly on “doing whatever it takes” to bolster economic growth. This has driven unprecedented liquidity into global equity markets. The US has led the way, and with US interest rates hovering around zero and equities yielding 1.85% (S&P 500 yield as of July 13th), we see little reason the rally can’t continue. It will, however, continue to be punctuated by gut-wrenching surges and downdrafts.

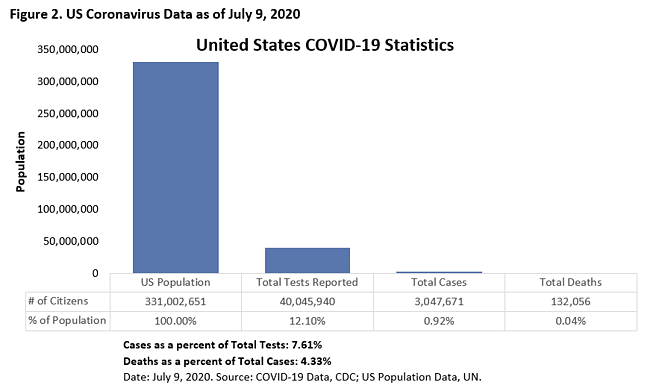

As horrific as the pandemic has been, it has infected only a small fraction of the US population. COVID-19 has infected less than 1% of the US population and 0.04% of Americans have died from coronavirus-related complications (see Figure 2), and according to a July 13th USA Today headline, two-thirds of Americans don’t know anyone who has had COVID-19. The relatively small number of coronavirus cases, particularly outside the hotspots of New York and California, combined with the personal and collective difficulties caused by economic closures and social distancing, have resulted in quarantine fatigue.

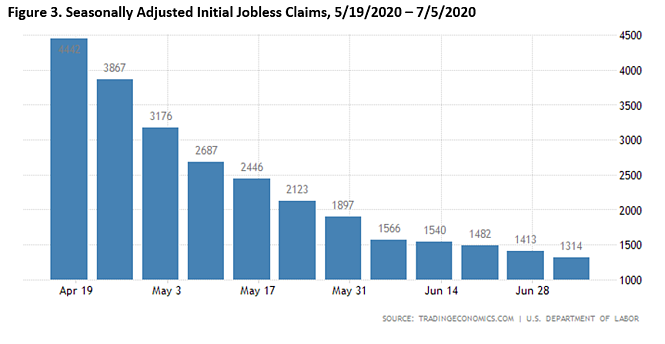

To escape quarantine fatigue, Americans are returning in droves to jobs that can’t be done remotely, travel (especially “road trips”), restaurant dining (particularly outdoors), shopping, and socializing. This escape from quarantine has resulted in a rapid acceleration in economic activity, which is reflected in the bi-weekly jobless claims data shown in Figure 3.

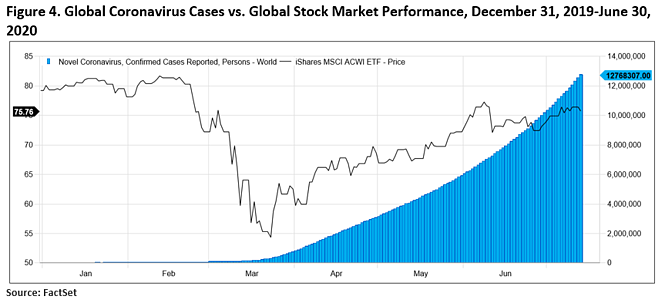

Economic growth and risk assets will remain on an upward trajectory unless the pandemic mandates backtracking on recent re-opening efforts. The latest data indicates coronavirus infection rates in the US are accelerating – particularly among young people – amid protests, economic re-opening, and quarantine fatigue. Yet the equity market remains strong (see Figure 4).

Although battling the pandemic remains our collective top priority, attention remains focused on the tradeoffs among stimulating economic activity, prospects for a vaccine or cure, and the potential for spurring new outbreaks of the disease. A careful balance must be maintained between the prospective economic and human costs. Against the backdrop of persistent personal and collective fear of a return to quarantine and its rapid, unprecedented economic consequences and an easily transmitted disease for which there is no cure, no vaccine, and unpredictable, sometimes fatal symptoms, we anticipate ongoing market volatility.

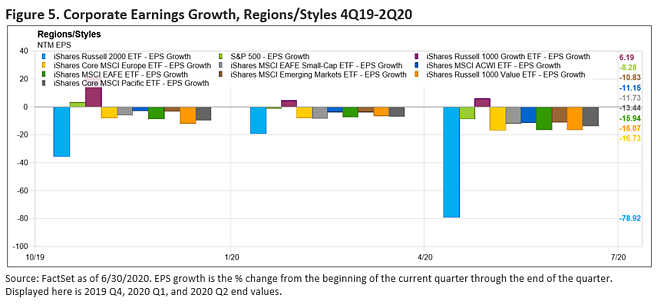

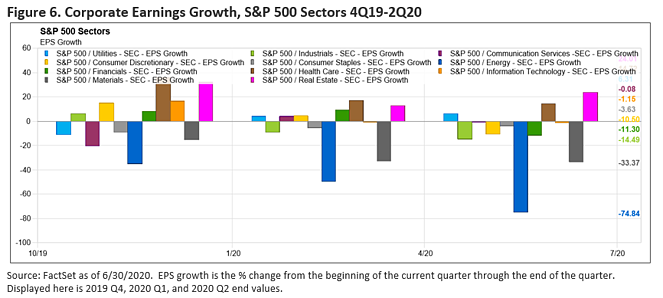

Earnings – Slower deterioration

Earnings projections have fallen quickly, and many companies have suspended guidance. Keeping in mind that earnings projections are changing as rapidly as adjustments are being made to economic forecasts, current earnings projections by regions, styles, and sectors are presented in Figures 5 and 6.

Valuations – A Moving Target

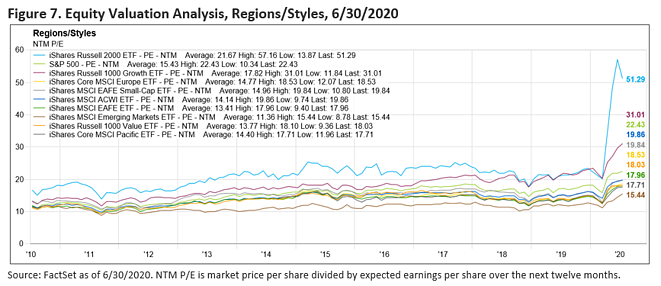

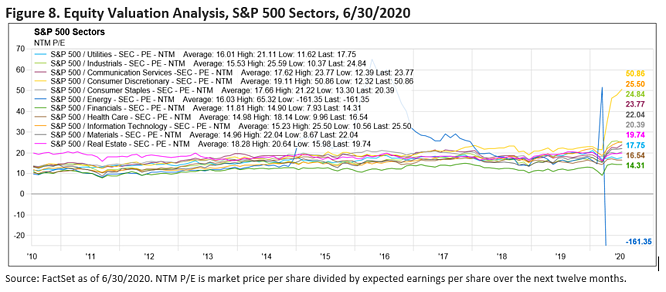

Equity valuations remain well above their 10-year averages – which is typical for the start of a recovery. The S&P 500 and Russell 1000 Growth indices remain at the highest valuations relative to their historic averages (see Figure 7). The MSCI AC Asia Pacific and Russell 1000 Value indices are least expensive on this metric.

Sector valuations look equally stretched – with (not surprisingly) the cyclicals at the most expensive end of the spectrum.

Achieving Long-Term Investment and Impact Objectives

As shown in Figure 9, the MSCI KLD 400 index outperformed the S&P 500 index in the second quarter. The sustained, consistent performance of this standard SRI/ESG benchmark over time and recent outperformance support our view that strategies incorporating environmental, social and governance (ESG) factors – with an eye toward making the world a better place – and mainstream financial returns are not mutually exclusive.

As always, everything we do at First Affirmative is driven by our dedication to enabling advisors to deliver financial results to clients and belief in the power of capital to bring about lasting environmental and social change. Our three Sustainable Investment Solutions – Custom, Multi-Manager, and Managed Mutual Fund – are built to enable clients to achieve their financial goals over the long term, along with their individual environmental, social, governance, ethical, and values-based objectives. Each portfolio is carefully constructed to be well diversified across assets, sectors, geographies, securities, and management styles –– and designed to weather periods of uncertainty and volatility.