2020: Taking Stock of Shareholder Engagement during Disruption

Last year garnered its own unfortunate but well-earned twitter hashtag: #2020worst. It brought us the onset of COVID-19, growing inequality as the stock market reached new highs and employment levels plummeted, rise of Black Lives Matters, ongoing political strife, a record year of natural disasters made worse by climate change… and the list goes on.

These overlapping challenges are symptomatic of a collective failure to adequately address the long-term environmental, social, and governance (ESG) risks that are the focus of our advocacy efforts. Although classifying issues as E, S, or G is standard practice, this past year made it abundantly clear that the issues we face cannot be easily categorized, that all issues have ES and G aspects, and that a more holistic approach is necessary.

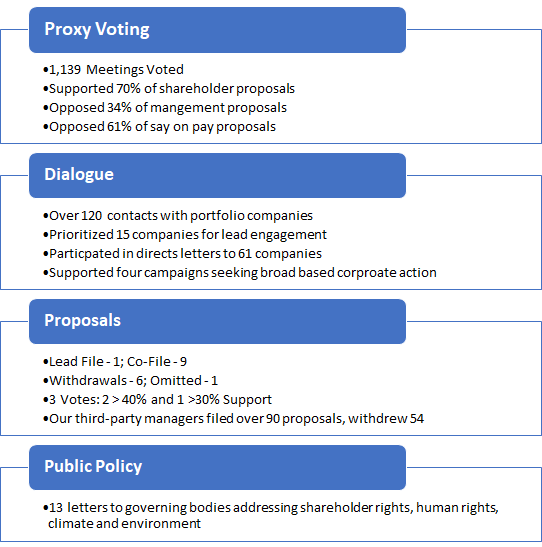

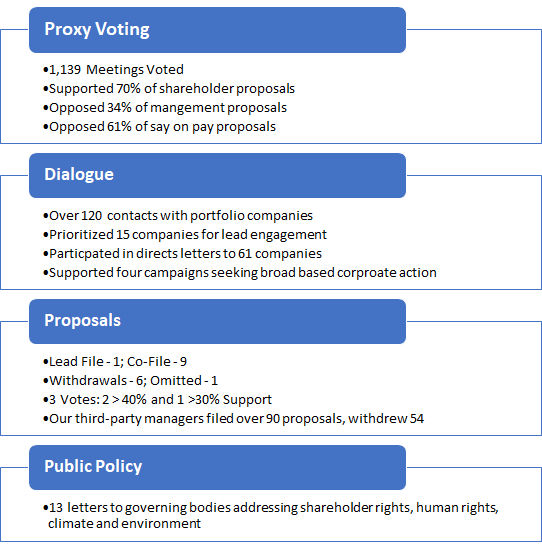

Fortunately, 2020 has also served as a catalyst for responsible investors to evaluate engagement priorities and tactics of engagement. Pressing social issues have been prioritized and more fully integrated into our advocacy work on climate, chemical risk management, diversity, and human rights, and you will see this reflected in this year-end review.

Proxy Season 2020