Falling Leaves and Economy?

By Mel Miller, CFA®, Chief Economist | Download PDF

Fall is here. As I watch leaves drifting down to the ground from my office window, I have to ask whether the economy will follow a similar pattern of slowly drifting lower. The summer was a record-breaker in terms of rainfall here in Wisconsin as flooding captured the headlines. The economy also is in the record-breaking territory, as the expansion is now the longest continuous expansion in history.

Now that the final readings are in for the quarter ending June 30th, was my forecast accurate? I predicted that the first-quarter growth of 3.1% would exceed the second quarter’s. I forecasted a quarterly GDP (Gross Domestic Product) of 1.75%-2%. The actual quarterly level was 2%, at the high end of my forecasted range. What do I see for the third quarter of 2019, the fourth quarter, and the next twelve months?

As world economies wrestle with the uncertainty of an expanding U.S. trade war with China, the negative impact is enormous. It is impacting world demand, and traditional supply chains are under siege. Eurozone countries are experiencing blowback from the U.S. trade war with China as their economies declined .2% in the second quarter.

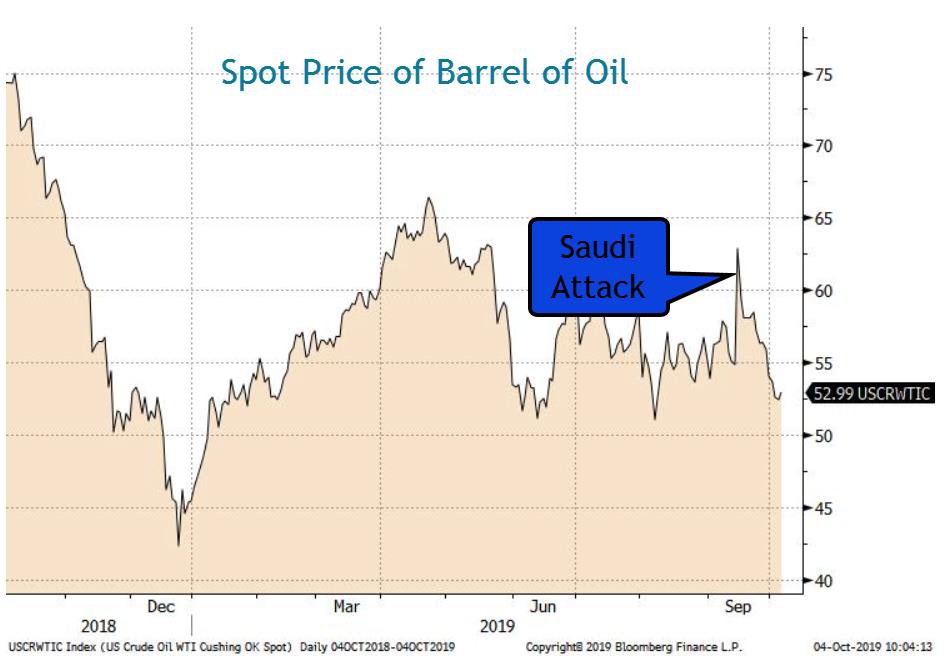

Another uncertainty appeared during the quarter, which shocked the world as allegedly, Iran launched a preemptive drone strike against Saudi Arabia’s oil production facilities, reducing its capacity in half. In the 1970s, such an action would have been devastating to the U.S., leading quickly to a recession. Such is not the case today, as the U.S. is a net exporter of oil. The price of oil jumped 15% in one day and quickly returned to the pre-bombing level.

The speed of the reduction is a testament to the weak world demand as well as the increase in supply. The fracking revolution has dramatically increased capacity, but at a shocking environmental and community cost. The attack has raised the tension level as President Trump responded with additional troops sent to Saudi Arabia. A further response in all likelihood is expected, adding to the uncertainty.

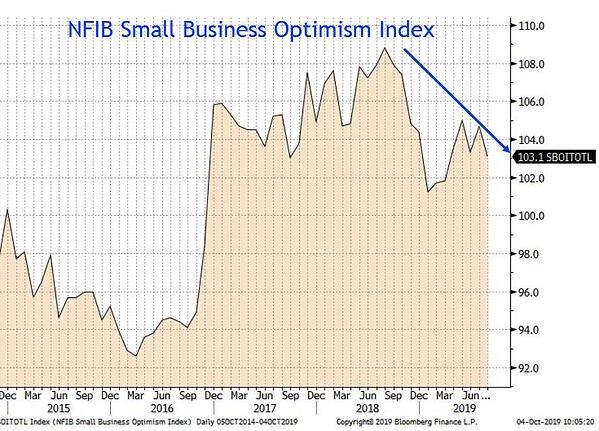

Business confidence in the U.S., boosted by a lowering of corporate taxes and regulation reductions, remains elevated, as evidenced by the NFIB Small Business Optimism Index.

The survey points to continued business confidence; yet, capital spending (CAPEX) continuing its downward trend. Executives state they are confident in the nation’s direction yet still refuse to commit company funds for expansion or upgrades. Interesting?

The Federal Reserve concerned about slowing world demand, trade wars, and U.S. rates higher than the rest of the developed world saw fit to reverse direction and lower the Fed Funds rate twice during the quarter to stimulate the economy. While not as aggressive as desired by President Trump, the Fed did not see the need to overreact with unemployment at a 50-year low.

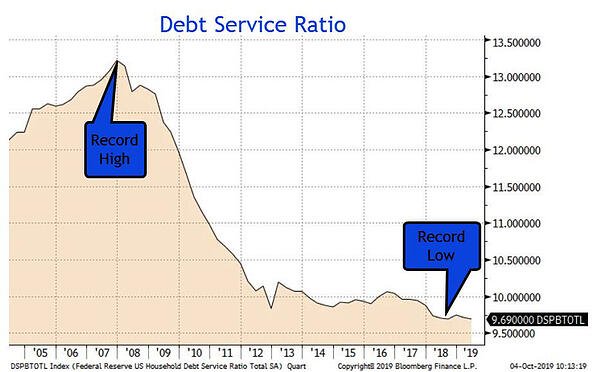

Since the business community is reluctant to spend for the future, the consumer holds the key to the future of the economy. Consumer spending is a must for the viability of the recovery. While still increasing at an impressive rate, consumers remain in a position to continue their spending pace. In an era of low interest rates, consumers have reduced their debt service ratio.

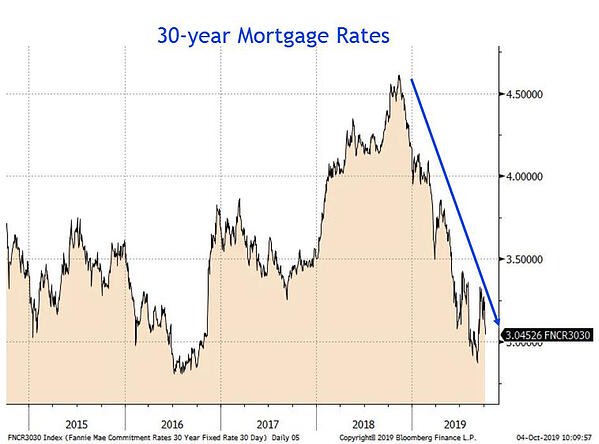

Debt payments as a percentage of disposable income ( income after taxes) reached a high of nearly 14% in 2007. Following the Great Recession, consumers have reduced their debt payments by paying off and/or refinancing debt. The current debt service percentage is at a record low of 9.69% and likely headed lower as home mortgage rates tumbled during July and August before reversing. Mortgage refinancing accelerated as mortgage rates declined to levels not available since 2016.

Where does this leave us at the end of the third quarter? One of my crucial recession predictors turned negative during the quarter, causing me to increase the probability of a recession in the next twelve months to 50%. The treasury yield curve inverted between the 2-year and 10-year raising my concern for the economy as the inversion historically signals a recession.

The primary cause of the slowing economy is the uncertainty resulting from an escalating trade war with China. Consumers now are seeing the impact of tariffs as price hikes work their way through the supply chain. Further tariffs scheduled for implementation in October will adversely impact the economy in the fourth quarter. There is no sign that the trade war will end this year.

The political risk rose dramatically at the end of the third quarter as House of Representatives voted to open impeachment proceeding against President Trump. Congress added to the political uncertainty by passing a continuing resolution that funds the government through November 21. The political climate raises the odds of a government shutdown as debt ceiling repercussions negatively impact the economy.

In summary, I estimate the third-quarter GDP growth was the same as the second quarter at approximately 1.75%-2%. As I look ahead to the fourth quarter, I can not foresee a pick-up occurring given the growing political turbulence; therefore, I lowered my forecast to 1.50%-1.75%. The leaves and the economy are falling.

Mel Miller, CFA® is Chief Economist and a member of the First Affirmative Investment Committee. He monitors economic conditions and market movements, and keeps the firm and its network advisors current on economic issues.

NOTE: Indexes are not available for direct investment. Mention of a specific company or security is not a recommendation to buy or sell that security. Past performance is never a guarantee of future results.

Source of graphic data: Bloomberg