By Theresa Gusman, Alex Cote, and Kaitlyn Mitchell

Overview – All Eyes on Global Economic Recovery

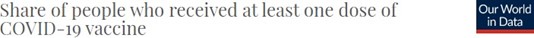

- The vaccination race has begun with nine countries already exceeding 25% of their population inoculated with at least one dose of vaccine.1

- Traders are anticipating rate hikes enacted rate hikes to curtail impending inflation, selling out of bonds, and pressing the 10-Year Treasury Yield to 1.7%.

- Massive stimulus, capped by this year’s $1.9 billion package, has the American economy poised for remarkable growth as COVID-related restrictions are lifted.

“The Biden administration has indicated the U.S. will have enough vaccines for all adults by the end of May. Our analysis of data from the three major vaccine makers suggests this is entirely feasible.

Efficacy data shows the current vaccines are effective in preventing severe disease and hospitalizations, which is what is needed for economic re-opening. The variants are perhaps the biggest risk to the restart, yet clinical data has shown current vaccines demonstrate sufficient efficacy against the known mutations — enough to provide immunity and alleviate hospitalizations.”2

“Markets have greeted the vaccine and stimulus news with higher bond yields, anticipating a move by the Fed to tighten monetary policy and raise interest rates. As of mid-March, bond investors expect the first Fed hike by the end of 2022 and a further two hikes in 2023. This seems premature and we agree with the Federal Open Market Committee’s mid- March projection that rate hikes are unlikely before the end of 2023.”

Main Risks – Inflation, Fed Responses, and Global Uncertainty

- As evidenced by a sharp uptick in US Treasury Yields, inflationary concerns continue to ripple through markets with economic conditions rapidly improving and COVID concerns subsiding.

- Fed responses to curb inflation, particularly the unraveling of quantitative easing measures and interest rate hikes, may be necessary sooner than expected and would decelerate growth.

- An uneven global economic recovery is likely. Developed countries like the US and UK have already vaccinated a significant population, while others have yet to commence the process.

Looking Ahead – A Steady Climb to Normalcy

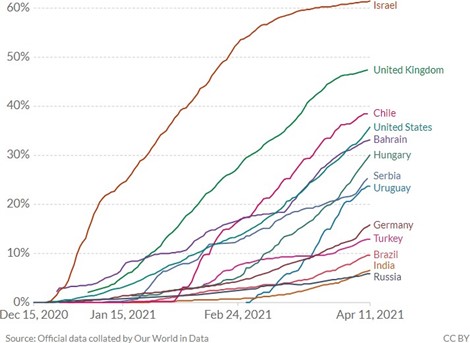

“The outlook for the global economy improved significantly as vaccine production and distribution ramped up with real GDP expected to increase by 5½% in 2021. This upgraded forecast reflects strong momentum heading into 2021 and expectations that monetary policy will stay extraordinarily accommodative and fiscal policy support will remain in place or, in some countries, increase. Optimism that economies will be able to sustainably reopen as virus spread eases remains subject to uncertainty given the growth in virus variants and logistical problems with vaccine distribution.”4

“After last year’s false start, the prospects for a sustained reopening of economies through the second half of 2021 appear promising. The vaccination rollout as well as prior COVID-19 infections mean 60- 70% of the population in most developed economies should have some immunity by early in the third quarter. This plus the large U.S. fiscal stimulus has shifted investors from worrying that growth will be too slow, to now fearing that growth will be too fast and put more upward pressure on interest rates.

We agree that economies are poised to rebound sharply as restrictions are gradually lifted, but we disagree that inflation pressures and interest rates are likely to increase significantly over the next 12 months. It’s going to take until at least the middle of 2022 for the U.S. economy to recover the lost output from the lockdowns, and longer in other economies. This means that broad-based inflation pressures are unlikely to emerge until 2023. It also means that market expectations for U.S. Federal Reserve (Fed) lift-off in 2022 are premature, with late 2023 or early 2024 a more likely timing for the first Fed funds rate hike.”3

- https://ourworldindata.org/covid-vaccinations

- https://www.blackrock.com/us/individual/literature/investment-commentary/taking-stock-quarterly-outlook-en-us.pdf

- https://russellinvestments.com/-/media/files/us/insights/corporate/2021-global-outlook-second-quarter-full- report.pdf?la=en&hash=582667844EABC16013B14689846EF79C07E29F21

- https://thoughtleadership.rbc.com/vaccines-put-global-economy-on-recovery-track/?_ga=2.166745470.157306533.1618246575- 1295254800.1617829726