Celebrating a Decade of Shareholder Advocacy

First Affirmative reached an important milestone at the end of 2018, marking 10 years since we launched our advocacy program, completing our first full year of direct corporate engagement in 2009. We have since pursued an increasingly ambitious advocacy agenda to expand our engagement reach and impact.

Our Ongoing Advocacy Commitment

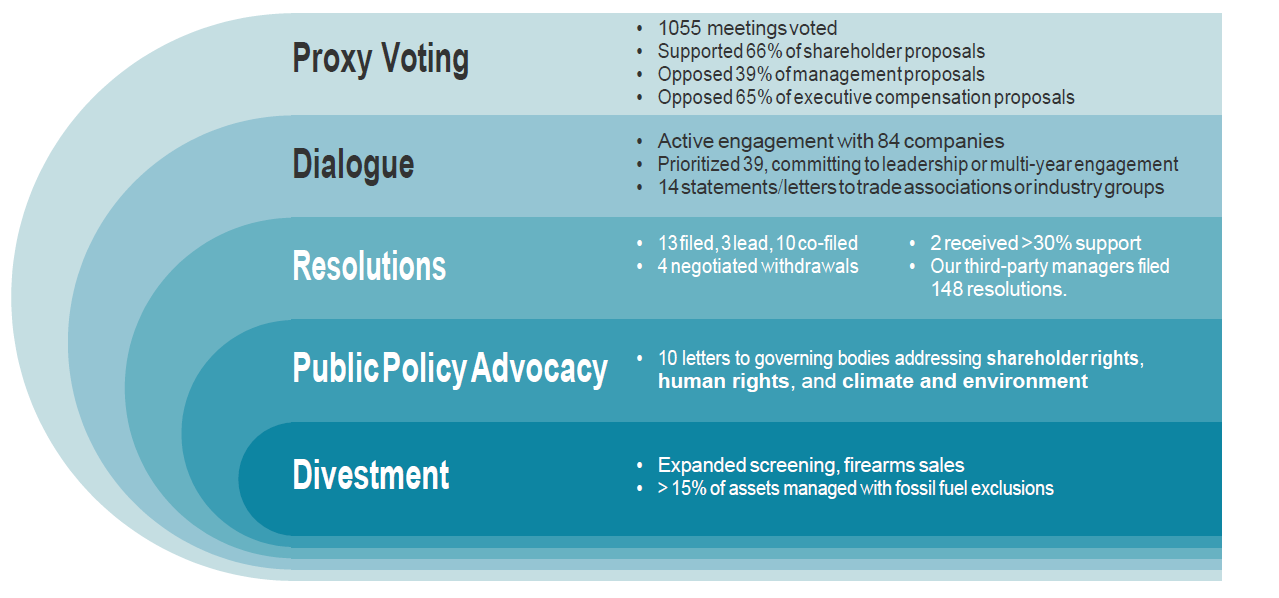

We devote significant resources and staff time to advocacy, making use of all the tools in the advocacy toolbox.Our commitments include:

- Voting client proxies according to customized,comprehensive proxy voting guidelines. We update these annually to ensure we include emerging issues.

- Meeting regularly with advocacy partners, both coalitions and investment managers, to prioritize issues and plan dialogues and resolution filings.

- Engaging in ongoing dialogue with companies, often in collaboration with advocacy partners.

- Filing and co-filing resolutions on behalf of our clients.

- Presenting resolutions at annual shareholder meetings nationwide with the help of our staff and network of investment advisors.

- Offering advocacy education and opportunities for engagement to our advisors and their clients.

- Founding the SRI Conference on Sustainable, Responsible, Impact Investing, celebrating its 30th year in 2019. The SRI Conference is a premier annual inspirational and educational event for responsible investors and investment professionals, where we take an active leadership role in educational developing content crucial to the advancement of the sustainable, responsible, impact investing movement.

Proxy Season 2018

Proxy Voting Record 2018

Shareholder Resolutions 2018

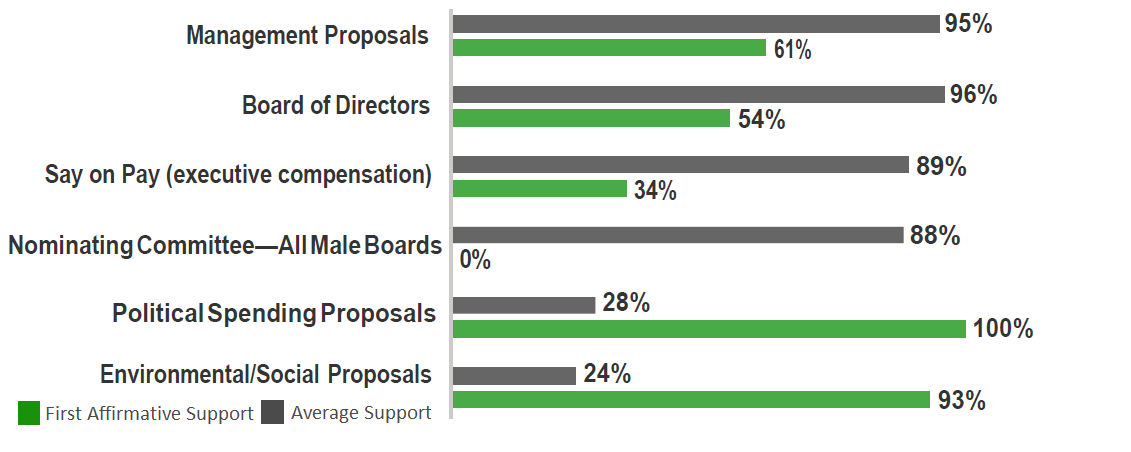

The divergence of our voting record on management proposals compared to the overall average reflects our opposition to the majority of pay packages, as well as to compensation committee board members who approve inappropriate pay packages and nominating committee boardmembers who fail to diversify their boards. Although the average results seem to indicate that scant progress has been made in shifting proxy voting practices to reflect amore sustainable path, there are favorable signs of change.

Ernst & Young found that support levels of 30 percent or more on environmental and social shareholder (ESG) resolutions increased from 29 percent of those resolutions in 2017 to 41 percent in 2018, a significant upward trend that reflects the change in voting behavior by major institutional investors. This shift in voting patterns needs to accelerate, but we are pleased with this improvement given our recent advocacy with Blackrock, J.P.Morgan and Bank of New York Mellon asking that they align their proxy voting policies with ESG investment strategies.

Integrating the Sustainable Development Goals

In 2015, all 193-member states of the United Nations (UN) adopted the Sustainable Development Goals (SDGs). These 17 goals (with a staggering 169 underlying targets) aim to address an array of urgent global topics such as climate, poverty, gender equality, and clean water. First Affirmative’s advocacy work has long aligned with many of the SDGs.

Many initiatives, frameworks and campaigns have been launched seeking to address pressing social, environmental and economic issues,but what is remarkable about the SDGs is the rapid and widespread acceptance of the goals across governmental, corporate and nongovernmental organizations. We certainly welcome the shared vision and language that the goals provide, but remain vigilant as we begin to integrate the SDGs as a framework for tracking how we, and the companies in which we invest, are contributing towards these goals.

Institutional investors and corporations are already publicizing—using the colorful SDG icons—how they are aligning with and contributing to progress towards specific goals. Finding alignment of products and services with an individual goal or goals seems a relatively easy task, but the tools to measure progress have yet to be developed. More difficult still, an honest accounting must take place when a company undermines goals.Unless a company can demonstrate that their contributions, both positive and negative, result in a net gain to society, meaningful progress will not be made.

2018 Shareholder Resolutions

| Company | Request | Outcome | SDG Alignment |

| Alphabet | Disclose policies and spending governing lobbying and detailing expenditures. | Voted, 9.4% support. This low support level actually represents a significant percentage of shareholders, but Alphabet utilizes a multiclass share structure that allows a few founders and insiders to retain about 60% of the votes. | 16 – Peace, Justice, and Strong Institutions |

| American Tower* | Report on setting energy efficiency and renewable energy goals. | Withdrawn. The company agreed to commit to goals in their first sustainability report, which has now been published and establishes baselines for goal setting. First Affirmative will continue dialogue to provide resources and monitor progress over time. | 7 – Affordable and Clean Energy 13 – Climate Action |

| ATT | Disclose policies and spending governing lobbying and detailing expenditures. | Voted, 34% support. As the company has not improved practices, we have co-filed again in 2019 with Walden Asset Management. Adverse publicity surrounding the Company’s decision to hire former President Trump attorney Michael Cohen heightens our concern. | 16 – Peace, Justice, and Strong Institutions |

| Bank of New York Mellon | Report on incongruities between the company’s proxy voting practices and policy positions regarding climate change. | 6.69%. The company engaged in dialogue. The bank’s support for climate related shareholder resolutions improved significantly from 2017 to 2018, indicating some responsiveness to investor concerns. | 13 – Climate Action 16 – Peace, Justice, and Strong Institutions |

| Citrix | Assess integration of sustainability metrics into CEO performance measures. | Withdrawn. The company agreed to include diversity and inclusion language in CEO evaluation and compensation documents and to adopt diversity targets. | 5 – Gender Equality 16 – Peace, Justice, and Strong Institutions |

| Comcast | Report on setting energy efficiency and renewable energy goals. | Challenged by company at SEC. Withdrawn by investors because the SEC allowed a similar resolution to be omitted at another company. The outcome on this resolution illustrates why First Affirmative is prioritizing work on shareholder rights, as we believe that this resolution addresses a critical material issue of investor concern. | 7 – Affordable and Clean Energy 13 – Climate Action |

| Conoco Philips | Disclose policies and spending governing lobbying and detailing expenditures. | Withdrawn. 21 investors co-filed this resolution. Extensive dialogue led to significant enhancements of lobbying spending policy and disclosure. Dialogue will continue with the company on this issue. | 13 – Climate Action 16 – Peace, Justice, and Strong Institutions |

| Mondelez | Assess environmental impacts of recyclable packaging. | 31.2% support. After the strong vote, subsequent engagement with the company led to a Mondelez commitment to making all of its packaging recyclable by 2025. | 12 – Responsible Consumption and Production 14 – Life Below Water 15 – Life on Land |

| Sealed Air | Report on steps being taken to increase board diversity. | Withdrawn. The Company enhanced guidelines to state that diversity of age, gender, international background, race, ethnicity, and specialized experience are considered in each director search. | 5 – Gender Equality 16 – Peace, Justice, and Strong Institutions |

| Travelers* | Disclose policies and spending governing lobbying and detailing expenditures. | Challenged by company at SEC. Withdrawn. The company significantly enhanced disclosures during our 4-year dialogue, but have yet to disclose lobbying done through trade associations. The company challenge cited substantial implementation and relevance. We withdrew in light of progress made and uncertainty given recent adverse SEC decisions. | 13 – Climate Action 16 – Peace, Justice, and Strong Institutions |

Note: Filings were also submitted at Morgan Stanley, Chevron and Amazon but were withdrawn due to filing deadline issues

Selected Highlights

Corporate Engagement

Board diversity — Over the last 18 months we reached out to portfolio companies with no women and/or racial diversity on their boards. After numerous dialogues, we are pleased to report that 5 of the 10 companies have revised nominating committee guidelines, and 4 companies have added one or more women to their boards. We filed a resolution for 2019 at non-responder Masimo Corporation.

Gun violence — We organized a 43 investment firm coalition to ask 15 banks and 3 credit card companies to disclose risk management policies and practices with regard to firearms lending and to add sales restrictions to merchant credit processing agreements. Regrettably, we received no commitments to our request for restrictions, as was perhaps expected given the divisive politics surrounding gun control. It is also not clear that more restrictive policies than what is legally required are enforceable given the current credit card processing system. However, two-thirds of companies responded, and we talked with three credit card companies and two banks, discussing their role in monitoring and enhancing risk-management practices at the point-of-sale and public policy engagement. An improved public policy environment may give investors better leverage.

Toxins — Small actions can reap big rewards. Lowe’s committed to end the sale of paint thinners containing highly toxic methylene chloride and N-Methyl-2-pyrrolidone (NMP) immediately prior to their 2018 annual meeting. With Lowe’s leading the way, 11 major retailers, including Amazon and Walmart, made similar commitments to phase out these chemicals. First Affirmative’s role? With our help, two clients delegated a total of 43 shares so that family members of two men who died as a result of using Lowe’s paint thinners could attend the Lowe’s annual meeting to bring the issue to shareholders. The news of their pending attendance facilitated the company’s rapid change in policy and led to industry scale change.

Public Policy

Shareholder rights — We continue to prioritize public policy efforts on the preservation of shareholder rights in the face of numerous campaigns, funded primarily by trade associations, to limit the filing of shareholder resolutions via congressional action and Securities and Exchange Commission (SEC) administrative decisions and rule- making. We are active participants in the Shareholder Rights Group, formed to represent the interests of individual and smaller institutional investors. We help to develop strategy, contribute to formal responses and recommendations to Congress and the SEC, and submit publications in the ongoing debate to support shareholder rights and to defend the existing well-functioning shareholder proposal process.

Environmental — We supported rulemaking petitions at the SEC requesting mandatory ESG reporting from public companies and mandatory disclosure from biofuel companies to expose inaccurate climate benefit claims. We continue to lend our voice to demands for sound climate policy, including signing the Global Investment Statement on Climate Change and supporting the Clean Power Plan at the EPA. We also supported the Cerrado Manifesto on Deforestation to oppose rampant deforestation in Brazil in part due to U.S. trade policies that have shifted soy bean cultivation from farmland in the United States to newly deforested Brazilian land.

Our Activist Managers

First Affirmative builds custom investment portfolios designed to align with client values and financial goals. In pursuit of these best fit portfolios, we engage an impressive array of investment managers who demonstrate leadership in unique and powerful ways by championing specific issues and leading multi-investor campaigns to drive change across entire industries. These managers took the lead in filing 115 shareholder resolutions in 2018 addressing a comprehensive array of ESG issues and co-filed an additional 33. First Affirmative collaborated on 9 of these resolutions.

Selected manager highlights

Boston Common Asset Management launched an investor campaign in 2014 with major banks that both evaluates and influences banks on managing and mitigating climate risk in their lending and investment portfolios. Boston Common’s outreach to 59 global banks in 2017 was supported by over 100 investors with almost $2 trillion in assets under management (AUM), resulting in a comprehensive update of the industry’s progress and challenges in transitioning to a low carbon future.

Green Century Funds leads investor efforts to halt deforestation through the Tropical Rainforest Campaign. Green Century mobilized investors representing $5 trillion in assets to join major global food companies in calling on the Roundtable for Sustainable Palm Oil (RSPO) to strengthen its standards. Thanks to their efforts, the newly adopted Principles and Criteria that govern the integrity of the sustainable palm oil market have been substantively improved. Green Century’s shareholder advocate recently traveled to Indonesia to meet with palm oil traders, processors, growers and financing banks to discuss deforestation; investor updates on the trip can be found on their blog.

Trillium had notable success in their negotiation with companies on a variety of ESG issues in 2018. They filed 40 proposals, withdrawing over half of them after obtaining policy commitments. Proposals that did go to a vote were supported by an average of 34% of voters, and two received majority support.

Zevin Asset Management’s engagement with Intel led the company to amend their supply chain policies to explicitly prohibit exploitative prison labor. More importantly, their work with Intel led to the adoption of this policy by the Responsible Business Alliance, a consortium of more than 120 electronics, retail, and toy companies.

Advocacy Partners

First Affirmative joins forces with non-profit organizations that support investor networks addressing sustainability issues through active ownership and corporate engagement. Each of these organizations provides specialized expertise that supports our corporate engagement on priority issues. Our primary advocacy partners:

Spotlight on New Alliances in 2018

The Investor Alliance for Human Rights (IAHR) was established to provide a collective platform for rapid response investor action on pressing human rights and labor rights issues and to promote corporate accountability on human rights.

The Plastics Solutions Investor Alliance, a project of As You Sow, is a 25 member international coalition of investors formed to engage consumer goods companies on the dire threat posed by plastic waste and pollution.

We joined The Investor Agenda, developed for the global investor community to accelerate and scale up the actions that are critical to tackling climate change and achieving the goals of the Paris Agreement. 400 institutional investors committed to the agenda as of its September, 2018 launch.

Follow our progress!

For timely updates on our advocacy activities, visit our website’s advocacy page and leadership blog. You can also follow us on Twitter and Facebook.