Finally: Significant Progress on Board Diversity

By Holly Testa

Download the PDF

First Affirmative has seen frustratingly slow, but nevertheless steady progress when it comes to board diversity. Of note this proxy season were our successful withdrawals of board diversity proposals at Masimo and Cambrex after both companies took steps to revise nominating committee guidelines and improve their search process to enhance board diversity.

Institutional Shareholder Services (ISS), the shareholder services firm that administers First Affirmative’s proxy voting activities, shed some light on the trends emerging with regard to corporate boardroom diversity in their May issue of Governance Insights. We are encouraged by the nationwide trends on board room diversity.

ISS reviewed 19,791 directorships in the Russell 3000 in order to evaluate new director appointments for 2019, and identified several trends:

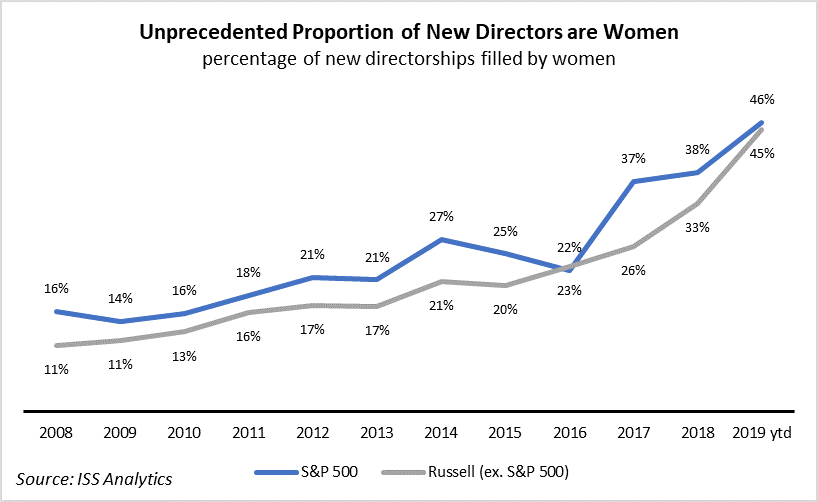

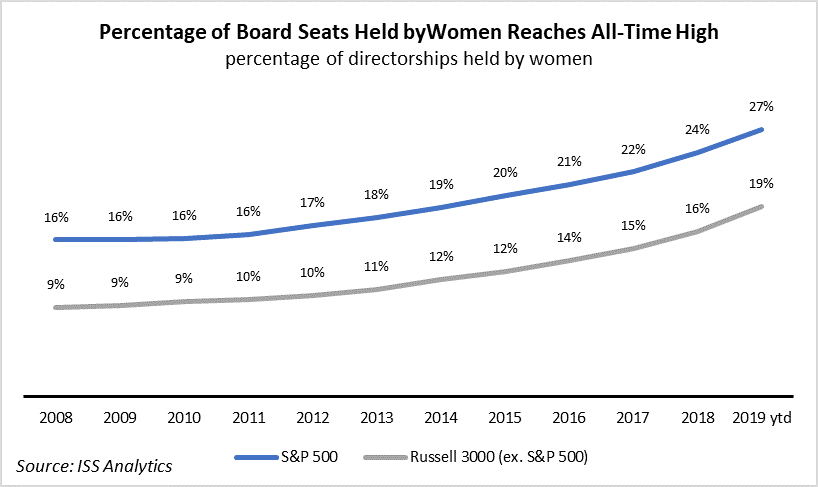

The percentage of women joining boards reached a new record high. 45% of all new Russell 3000 board seats were filled by women in 2019, as compared to 12% in 2008. 19% of Russell 3000 seats are now held by women, and for the S&P and 500, 27% of board seats are now held by women. In past, action on board diversity was dominated by the largest companies reflected in the S&P 500, but this year the rate of new women board members added at smaller companies was almost at parity with the large companies, reflecting a marked shift across the board.

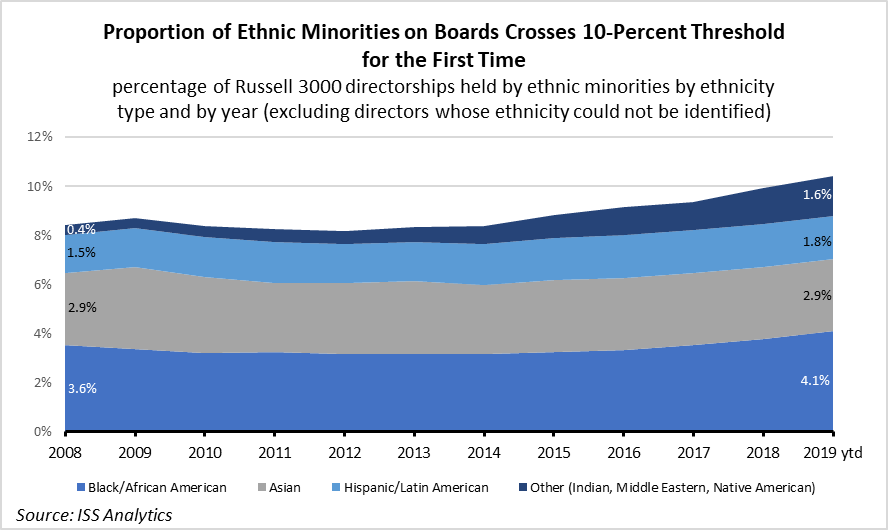

Ethnic diversity also reached record highs, but has grown at a much slower rate. 15% of all new Russell 3000 board seats were filled by ethnic minority directors, and 10% of Russell 3000 directors belong to an ethnic minority.

New director appointments focus on non-financial skill sets. Another important trend here is the increased diversity in the critical skill sets that can enhance the effectiveness of a board. Leadership, financial, and industry skill sets have dominated, but increasingly board members are coming to the table with international, environmental, social, governance, and human resources expertise.

The average director age continues to increase. The average director age in the Russell 3000 is 62.1 years, up from 59.7 years in 2008. The percentage of directors above the age of 67 years is at a record high 31.6%, compared to 22.1% in 2008. This reflects the often long tenure of board members, as companies choose to add members to their board to address diversity concerns rather than replace existing board members.

Although boardroom diversity is moving in the right direction, there is no indication that this enhanced diversity “trickles down” to the “C-suite” of corporate management. Women in the C-Suite: The Next Frontier in Gender Diversity discusses this next big challenge. With only 5.1% of CEO’s and only 9% of top executive positions filled by women, now is no time to rest on our laurels. The 56.6% support received by Trillium Asset Management’s recent resolution asking Newell Corporation to prioritize C-Suite diversity clearly demonstrates investor interest in diversity reaches beyond the boardroom.

Proxy season 2019: The Votes Are In

ISS provided an early take on voting outcomes, now that the vast majority of corporate annual meetings have taken place. Here are some of our thoughts regarding these overall trends:

Director elections face the strongest opposition seen in the past nine years.

Our take: The uptick in opposition still only produces a scant 4.9% of director election items with less than 80% support, and less than 50% support is at .19%. Given that our concerns regarding executive compensation and diversity led us to vote against directors 45% of the time, this “strongest opposition” is, in fact, nowhere near enough to promote needed changes in the boardroom.

Say-on-pay proposals received one of the highest opposition rates since their introduction to U.S. ballots in 2011.

Our take: Again, this trend is positive, but does not appear to be enough to significantly stem the tide of excessive executive compensation. 13.5% of say-on-pay proposals received less than 80% support, while only 2% failed. Meanwhile, executive compensation levels continue to climb even when stock market returns are negative. Our proxy voting guidelines led us to vote against 65% of say-on-pay proposals.

Environmental and social shareholder proposals continue to garner overall support, with the average support levels reaching 30% and 48% of these proposals receiving support above 30%.

Our take: Slowly but surely, major institutional investors appear to be accepting the business case for corporate action on critical long-term issues like climate change and diversity, and are increasingly supporting selected shareholder resolutions. We consider 30% to be a crucial support threshold, as companies are still likely to appreciate the need to accommodate this significant minority of investor sentiment. As one company we talked with acknowledged, “we see the writing on the wall” — this after an over 40% vote in support of our political spending resolution.

The four proposals that were filed by First Affirmative all garnered over 33% support from shareholders in 2019.

Overall shareholder support for environmental and social proposals has increased from 6% in 2008 to a remarkable 30% as of June 30, 2019. We hope to see this trend continue in the coming years.

First Affirmative honored as “Best for Customers” in 2019

First Affirmative is proud and honored to have been named “Best for Customers” in 2019 at the Best for Colorado award celebration by The Alliance Center in partnership with B Lab.

We do what we do with full transparency and genuine spirit to make this world a better place for our customers, our communities, and our planet alike.

Affirmative Impact is a publication of First Affirmative Financial Network, LLC (Registered Investment Advisor, SEC File #801-56587). The opinions and concepts presented are based on data believed to be reliable; however, no assurance can be made as to their accuracy. Mention of a specific company or security is not a recommendation to buy or sell that security. Past performance is never a guarantee of future results. For information regarding the suitability of any investment for your portfolio, please contact your financial advisor.

The views expressed herein are those of First Affirmative and may not be consistent with the views of individual investment advisors or Broker-Dealers or RIA firms doing business with First Affirmative. Network Advisors may offer securities through various Broker-Dealers and Registered Investment Advisory firms. These affiliations, and all fees charged to clients, are clearly disclosed. First Affirmative’s ADV Disclosure Brochure is available any time. Please write or call for a copy, or visit firstaffirmative.com/about-us.