“March Madness” Turns to March Sadness

By Mel Miller, CFA®, Chief Economist | Download PDF

As an economist, I rely on government and industry statistics to determine not only my analysis of the current economy but to formulate my forecast of the future direction of the economy. Tempering my investigation is the built-in lag time in the releases of at least one month. Typically a one month lag is of little consequence as an economy does not change rapidly but merely continues or reverses well-established trends. In a “normal” economy, I feel reasonably confident in describing the current situation, adding my interpretation, and forecasting the next quarter’s economic outcome within a small margin of error. I define this process as writing “non-fiction.”

March saw the end of my ability to create “non-fiction” as a “black swan” event gripped the world. A “black swan” event, as coined by Nassim Nicholas Taleb in his famous book titled The Black Swan, The Impact of the Highly Improbable, is an event with the following three attributes.

First, it is an outlier, as it lies outside the realm of regular expectations. Second, it incorporates an extreme impact. Third, human nature makes us develop explanations for its occurrence after the fact so we can apply probabilities to reoccurrence. An outbreak of the coronavirus-COVID-19 fits the definition of a “black swan.” Professor Taleb stated, “ Black Swan logic makes what you don’t know far more relevant than what you do know.” I would highly agree, thus the prerequisite of including a high degree of “fiction” in my Economic Commentary. January and February economic data comprises the “non-fiction” portion, March and beyond data, the “fiction” portion.

Non-Fiction:

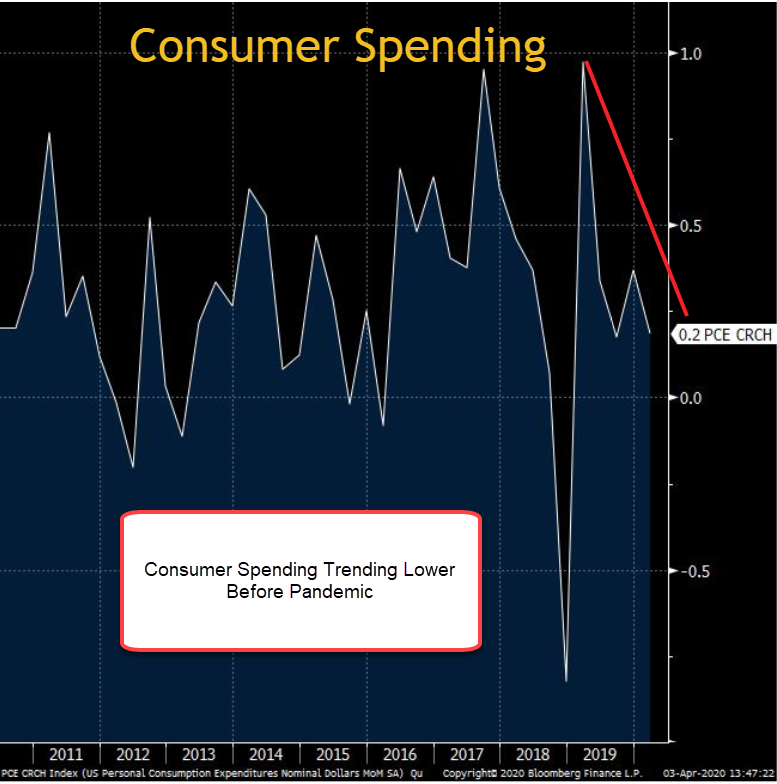

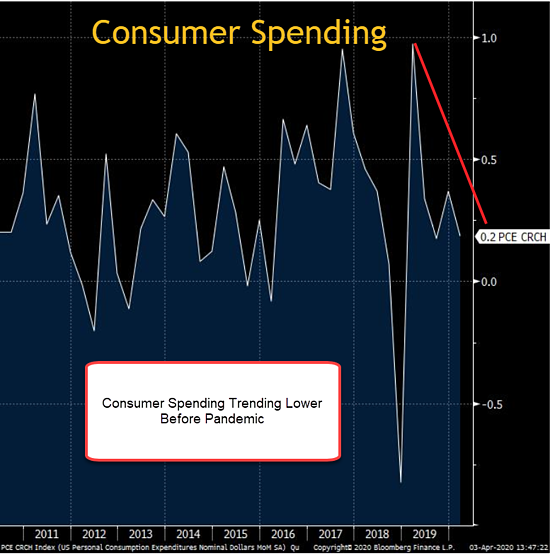

Consumer spending continued to be the economic driver during the first quarter. What is interesting to note, however, was the developing negative trend through February. Slowing consumer demand pointed to a slowdown in the first-quarter GDP (Gross Domestic Product).

Personal savings as a percentage of disposable income (income after taxes) was definitely on the rise, reaching nearly 8% and trending higher. The cautious consumer, influenced by non-coronavirus factors, decided to slow spending.

The business sector turned cautious before the consumer decision. The annual change in capital goods new orders reached a cycle peak in 2017 and was on a downward projection before the pandemic initiation. Concern over the disrupted supply chains resulting from the trade-war tariffs had a significant influence on their cautiousness.

I am not saying the economy was in a recession in February but, it was weakening. Unemployment stood at 3.5%, over a 50-year record low, yet the initial number of weekly individuals being laid off was trending higher. It is now time to leave the “non-fiction” weakening economy of January and February and venture into the “fiction” portion.

Fiction:

During March, I have participated in numerous conference calls with economists sharing ideas and forecasts as to the future direction of the economy. The opinions vary widely, all with little empirical evidence. The current situation is a “black swan” event by definition, which means we can not rely on past occurrences to predict the future. An additional factor hampering understanding is the informational vacuum provided daily by the President.

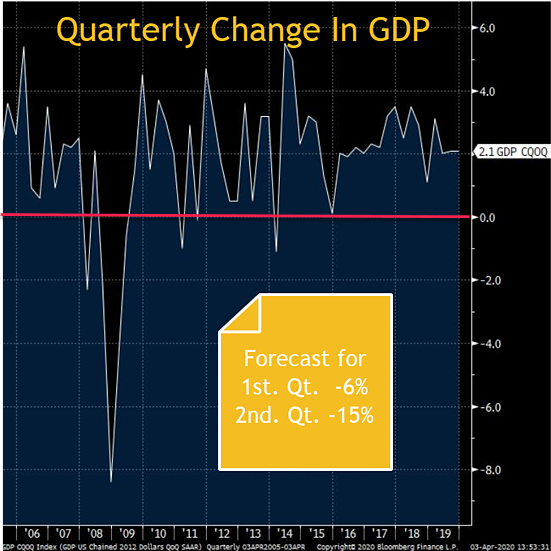

Before the national “shutdown,” I felt GDP was tracking a positive 1.25-1.5% first quarter. Now that has all changed as the economy has come to a standstill. Before the pandemic, the negative impact of the “trade war” was the key concern, now the issue is how bad will the situation become? When will the nation get back to “normal?” President Trump recently extended the nation-wide “social distancing” guidelines to April 30. Many state governors have gone beyond “social distancing” and have implemented and enforced “stay-at-home” orders for their residents.

The economy thus fell off the cliff and is now contracting as of March. My “fictional” guess for the first quarter of 2020 is a quarterly GDP of -6%. Yes, the economy is currently shrinking, and if the second quarter is also negative, then an official recession is declared.

There is no hope that the economy will avoid an “official” recession. The only questions that remain are, “How bad is going to be?” “Will the contraction exceed the Great Recession of 2007-2009?” and “What will be the shape of the recovery?” I wish I knew, but I will share my current “estimates.”

The economy will not reach the trough until the latter part of the second quarter. The GDP quarterly contraction will be severe as I am forecasting a -15% for the second quarter. The economy was slowing in the first quarter and then hit an unexpected wall-demand shock. The stock market hit a similar obstacle as it fell 34% in one month. Could the GDP decline by more than 15% in the second quarter? Yes. I have seen forecasts as low as -34% for the second quarter and as high as a positive 2.2%.

How will the recession of 2020 compare to the Great Recession of 2007-2009? If I am close to accurate, the current downturn will be more severe, at least for two quarters before initiation of a rebound. As I am now forecasting at least two straight negative quarters, the only question that remains is the “shape” of the decline and recovery.

Many forecasters are predicting a “V” shaped recovery. I am not. The United States is primarily a service economy and not a manufacturing economy like China. It is much easier for manufacturers to recoup losses resulting from a shutdown than a service economy. In many cases, service-oriented businesses never can recover the revenue lost during a “lock-down.” Your local barber will not charge you for the monthly haircut you missed when you can revisit the shop. Once able to dine out again, diners will not double their visits. I am not predicting the economy will never recover to the pre-coronavirus growth path. I am suggesting the recovery shape is more likely to resemble a “U.” I would not be surprised if the US experiences four straight negative quarters. I am not predicting an “L”-shaped economy. Keep in mind this forecast is thankfully incorporated in the “fiction” section and is merely my “guess” as of March 31.

The economy will recover because of Congressional and Federal Reserve stimulus actions implemented, just not sure of the when.

I missed “March Madness,” but I will not miss March. Stay safe.

Mel Miller, CFA® is Chief Economist and a member of the First Affirmative Investment Committee. He monitors economic conditions and market movements, and keeps the firm and its network advisors current on economic issues.

NOTE: Indexes are not available for direct investment. Mention of a specific company or security is not a recommendation to buy or sell that security. Past performance is never a guarantee of future results. Source of graphic data: Bloomberg