Slowing Continues

By Mel Miller, CFA® | Chief Economist

The December Economic Commentary highlighted my concern that the economy might have slowed “too much.” As I share the first quarter results in this publication, I still can not answer the question. The fourth quarter Gross Domestic Product (GDP) grew 2.2%. The first quarter GDP slowed from the fourth quarter but by how much? Is a recession on the near horizon? Let’s examine the data.

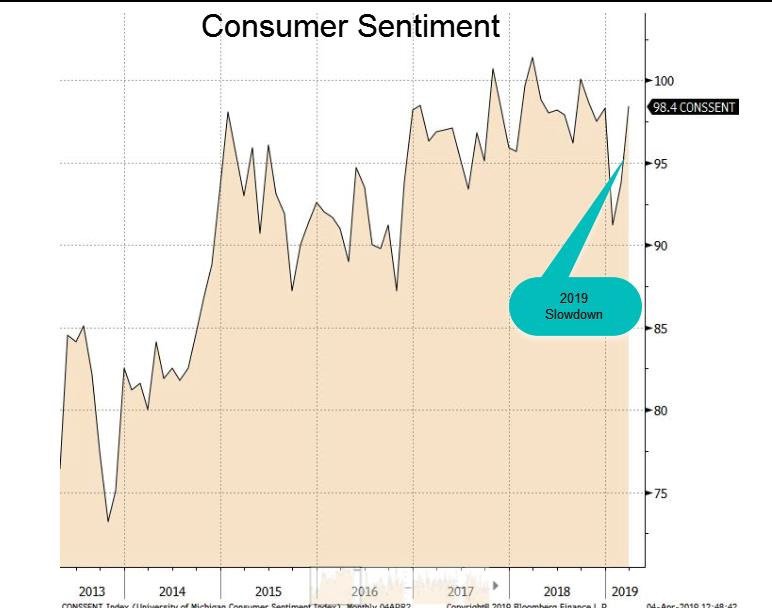

Consumer sentiment as measured by the University of Michigan Consumer Sentiment Index is well above the long term average; even though the index has moved lower in the last year. The strong job market fueling above-inflation wage gains is the prime driver.

The composition of the wage gains is decidedly encouraging. Beginning in 2018 hourly earnings growth for the bottom 50% of workers finally exceeded those in the top 50%. Wages of the bottom 50% of workers is expanding at nearly a 4% rate, while the top half of workers wages are growing at a 2% pace. The current situation has not been the case for a long while.

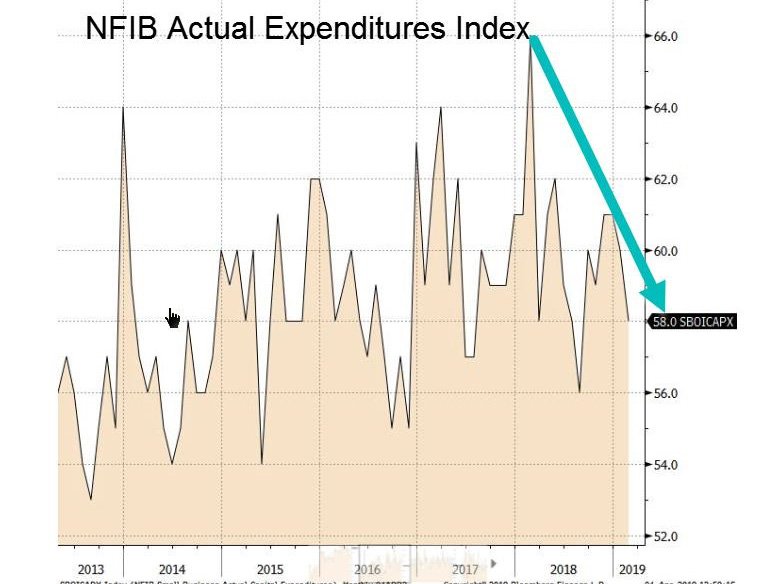

Business sentiment as measured by the National Federation of Independent Businesses (NFIB) has declined in the last two quarters as concerns over an expanding trade war negatively impacted attitudes. Still, the index was coming off a record high, so the current level remains optimistic. The number one problem cited by business respondents is a lack of qualified workers. Even as the economy slows, the shortage of workers should continue to drive wages higher for some time and provide a floor for slumping retail sales.

The Tax Cuts and Jobs Act of 2017 incorporated lowered corporate tax rates and accelerated equipment write-offs which promised to jump-start business expansion and modernization. Unfortunately, that has not been the case as evidenced by the NFIB Small Business Actual Expenditures Index. If small business capital expenditures are lacking, maybe large publicly traded companies have picked up the slack?

S&P 500 companies, according to a study by Goldman Sachs, will spend a record $940 billion in stock buybacks in 2019 while only allocating $780 billion on capital expenditures. This financial engineering is beneficial to stockholders but does not enhance future growth potential. Even though the economy slowed in the first quarter, the S&P 500 rose over 13%. The technique is working for now.

Jerome Powell, chair of the Federal Reserve, announced the Fed’s decision in March to halt the rate increase program begun in December 2015. As late as November 2018 the markets were looking for three additional rate increases (75 bps.) in 2019. Within the first quarter, though the markets are forecasting no more rate increases and in fact over a 50% chance rates will need to be reduced by September. What caused the markets to change their opinion on the strength of the economy?

I mentioned in the last issue of this publication that the actions of President Trump would determine the fate of the US economy. The tariffs(taxes) levied against our trading partners is having an adverse reaction on growth. Germany is Europe’s largest economy. During the 4th quarter, its economy (GDP) turned slightly negative and is expected to slip further into negative territory in the 1st quarter. Recessions commonly defined as two straight negative quarters; therefore, Germany probably entered an official recession at the end of March. European slowdown comes with their interest rates extremely depressed. As an example, Germany’s 10-year sovereign debt trades at a zero yield. Slowing world demand is one of the causes of our slowdown.

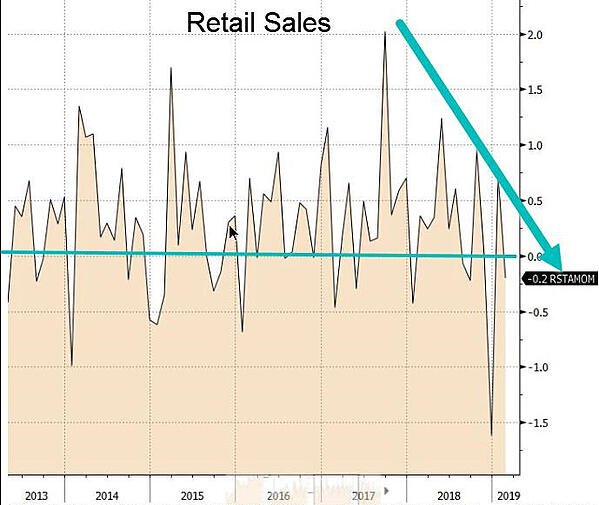

Another factor is the American consumer, who has suddenly become cautious in spite of stating they remain optimistic. Retail sales retreated during the fourth quarter of 2018 and continued sub-par during the first quarter. In another sign of building caution, the personal savings rate, on the rise starting Q4, points to a more restrained consumer.

Existing and new home sales YoY remains negative. Vehicle sales rates, the second largest consumer purchase category behind homes, also declined during the quarter. Given above-inflation wage gains, more jobs available than available workers, yet a reluctant consumer. Interesting.

Let’s examine a couple of popular economic indicators for additional signs of weakness. The slope of the Treasury yield curve is often cited as a recession indicator if it inverts (short-term rates higher than long-term rates). Currently, the 3-month T-Bill is yielding 2.42% while the 10-year is yielding 2.41%. I prefer comparing the 2-year to the 10-yearwhich is still slightly positive but barely.

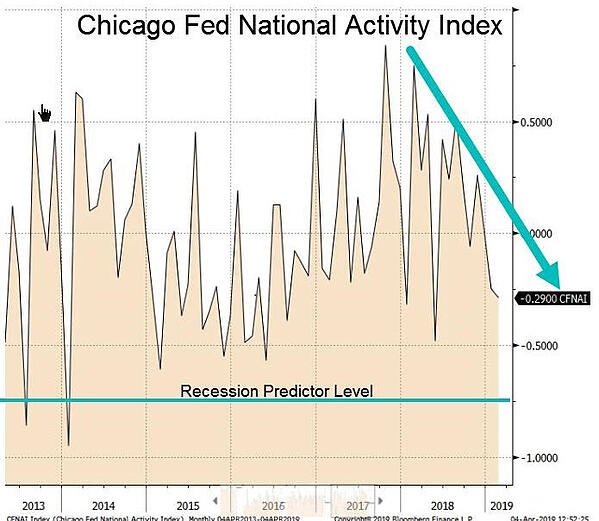

The Chicago Fed National Activity Index is a weighted index of 85 indicators of national economic activity and inflationary pressures. The Index moved lower during the quarter and is now predicting declining inflationary pressure and below long-term average growth. It is still above the recession predictor level, but the trend is alarming. The oft-quoted Conference Board’s US Leading Indicators Index shares the same pattern as the Chicago Fed Activity Index as it has declined this year, but remains above recession levels.

What are the conclusions? Given the negative trend of a couple of my crucial recession predictors, I have raised my probability of recession from 20% to 35%. The first quarter GDP slowed from the prior quarter’s 2.2% pace. I predict the first quarter GDP growth declined and will be in the range of 1.25%-1.75%.

With growth slowing what could push the economy over the edge into negative territory? The key remains the ongoing and postponed trade negotiations deadline with China. The business community lacks, but demands clarity, and is therefore reluctant to expand operations. An expanding trade war could be a recession catalyst as well as closing the border with Mexico.

Mel Miller, CFA® is Chief Economist and a member of the First Affirmative Investment Committee. He monitors economic conditions and market movements, and keeps the firm and its network advisors current on economic issues.

NOTE: Indexes are not available for direct investment. Mention of a specific company or security is not a recommendation to buy or sell that security. Past performance is never a guarantee of future results.

Source of graphic data: Bloomberg