One for the Record Books

By Mel Miller, CFA® | Chief Economist

In spite of growing trade war tensions, especially with China, one would not expect a robust economic showing during the third quarter. Yet the economy continues the expansion that began in 2009. In fact, I want to highlight a couple of records that were broken in the third quarter.

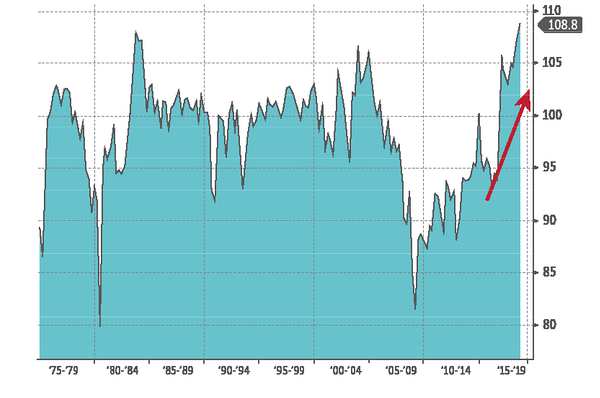

NFIB Business Optimism Index

The National Federation of Independent Businesses Optimism Index shattered a record previously set during the Reagan era. In August, a new record of 108.8 was established. What is driving this optimism on the part of small business owners? Based on the survey responses, the majority of business owners reported job openings, feel now is a favorable time to expand, expect the economy to improve, plan to make capital outlays, and hope to grow employment. Further, 62% of owners reported trying to hire, with 89% of those owners finding few or no qualified applications for their open positions. In another sign of a tight labor market, 25% of those owners surveyed reported lack of skilled workers as the single most important business problem.

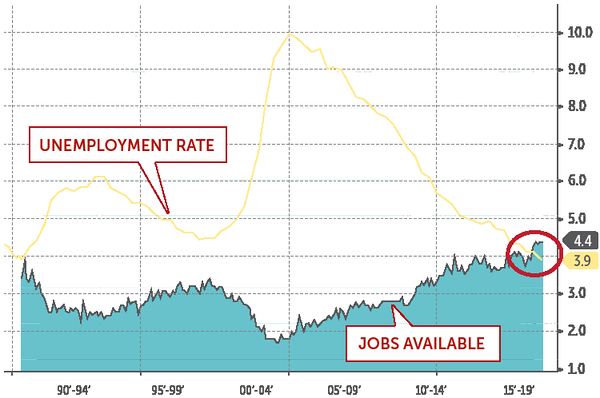

An economic measure not often cited, but one I feel is very important, is the U.S. Job Openings Rate. This measure reached an all-time high during the quarter of 4.4%. When compared with the current unemployment rate of 3.9%, one can discern that there are more job openings than potential workers-another one for the record books. Assuming unemployed personnel are qualified and located where the job openings exist, in theory a zero unemployment rate is possible. In reality, workers possessing the necessary skills for the available jobs are in short supply. It is easy to make the case that without more workers the growth potential of the economy is limited. What is needed is an immigration policy allowing additional qualified workers to immigrate to this country. Doesn’t look likely given the current political climate.

Jobs Available and Unemployment Rate

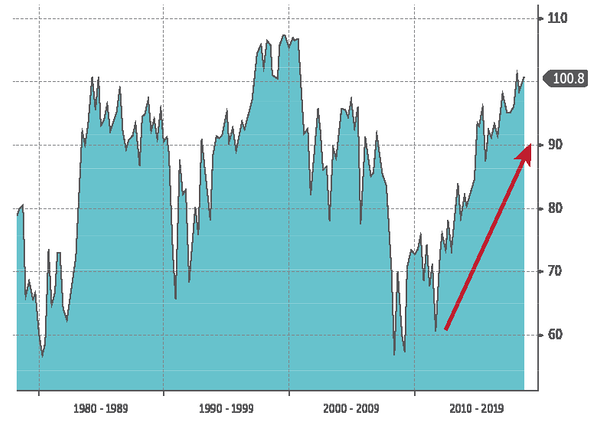

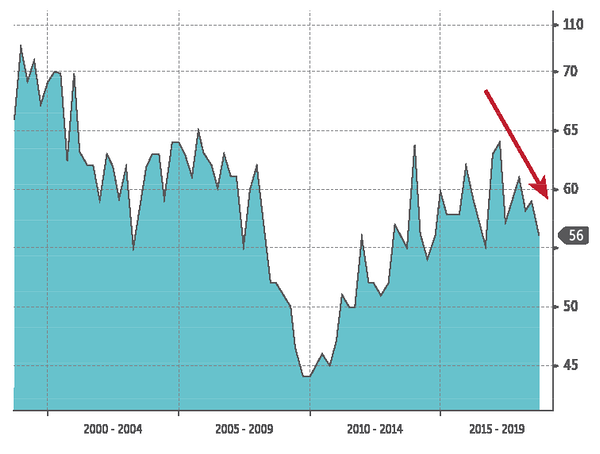

The business community’s optimism, at a record level, is nearly matched by consumer sentiment which is measured by the University of Michigan Consumer Sentiment Index. Consumers are encouraged by the tight labor market, increasing home prices, and an increasing stock market. The index currently is within striking distance of the all-time high reached in 1999.

Consumer Sentiment Index

The level of business and consumer optimism is somewhat surprising in light of an expanding trade war threat. Because of long-term contracts the impact of expanding tariffs to date is only being felt by commodities and selected individual companies. Farmers have seen the most significant effect but Federal Government assistance is promised.

President Trump has stated that foreign companies will pay the cost of the tariffs. Most economists say his premise is not correct, and once the taxes take full effect, retail prices will rise. Tariffs and taxes are synonymous.

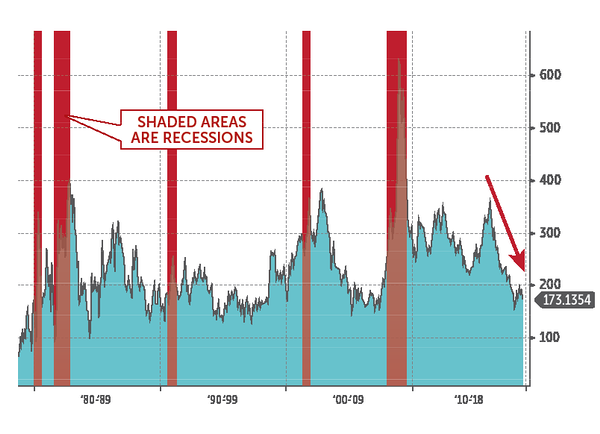

A bond market indicator which I utilize to measure the investment community’s willingness to take risk is called the business cycle risk. Calculated as the difference (spread) between the BAA 10 Year bond index(low-quality bonds) and the 10-year Treasury yield(risk-free). When the difference is low, as is the current situation, investors are willing to invest in risky investments for a small premium to the risk-free treasury bond. This is called “risk-on,” predicting the risk of a recession is low. When the spread widens, the investment community is said to be “risk-off,” and the economy is either in a recession or one is on the horizon.

10 Year – 2 Year Treasury Yield

Conclusion: the business cycle risk measure indicates the investment community is just as optimistic as consumers and the business community.

One might conclude that with record levels of optimism, retail sales and CAPEX business expenditures are soaring. Wrong. The monthly increase in retail sales for the last 10 years has averaged 0.3% per month. Recent monthly releases are trending lower rather than gaining momentum. The actual capital expenditures for small businesses as recorded by NFIB Capital Expenditures Index moved lower during the third quarter. Small businesses are not impacted as much by the trade war as large multi-nationals, which makes the recent declines somewhat worrisome.

Unemployment vs. Job Openings

I stated in the second quarter Economic Commentary that “I do not see a recession on the horizon, but with the current geopolitical situation and rising interest rates, I predict that the second-quarter growth will mark the highest quarterly growth rate for the next couple of years.” The first quarter GDP growth rate was 2.2% followed by the strong second-quarter growth rate of 4.2%.

What do I see in the third quarter? While both consumer and business sentiment reached or nearly reached all-time highs during the third quarter, economic data has not been nearly as robust. Unfortunately, the short-term economic impact of Hurricane Florence is negative, while over the first part of 2019, rebuilding will provide a slightly positive effect. I have not changed my opinion shared in the last Economic Commentary. I am looking for third-quarter GDP of approximately 3%, at least 1% lower than the second quarter.

Mel Miller, CFA® is Chief Economist and a member of the First Affirmative Investment Committee. He monitors economic conditions and market movements, and keeps the firm and its network advisors current on economic issues.

NOTE: Indexes are not available for direct investment. Mention of a specific company or security is not a recommendation to buy or sell that security. Past performance is never a guarantee of future results.

Source of graphic data: Bloomberg