Stay the Course

Overview:

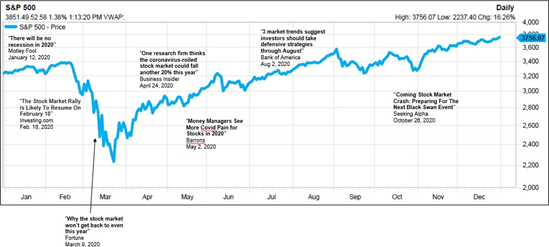

- As volatility reigned amid COVID-19, fiscal and monetary stimulus, political wrangling, and social unrest, the S&P 500 advanced 18.4% in 2020, following a 31.5% gain in

- US stocks continued to outperform non-US, growth continued to outperformed value, large capitalization continued to outperform small, and technology continued to dominate in 2020. These trends reversed in the fourth quarter, with non-US equities, small value, and energy at the top of the leader board.

- The shift into sustainable, responsible, and impact (SRI) investments accelerated in 2020 driven by the global pandemic – along with rising climate risk awareness, social unrest, and growing recognition that financial and impact objectives can be achieved simultaneously. From January 1, 2020 to September 30, 2020, $203 billion flowed into ESG funds, and the MSCI KLD 400 Social Index outperformed the S&P500.

- Interest rates, inflation, and a return to normal economic activity—whatever that looks like in a post- pandemic world—will determine the trajectory of the markets this year. Like 2020, investors who stay the course amid market volatility and conflicting prognostications will continue to be rewarded

- Figure 1. S&P 500 Performance and Prognostications, 12/31/19-12/31-20