Wait! What?

Overview

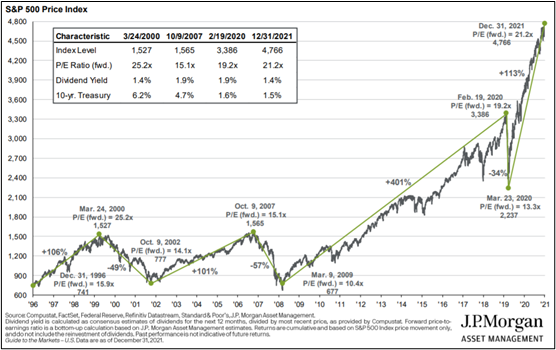

Following a 27% gain in 2021, the S&P 500 was 113% above its March 23, 2020, pandemic low and 41% above its pre-pandemic high (see Figure 1 below) at fourth quarter end. As we entered the fourth quarter, we were optimistic that COVID was “under control” and naively convinced it was moving from anxiety-inducing pandemic to endemic nirvana. That didn’t last long – and neither did the powerful restart of economic activity. At the same time, equity and fixed income markets have begun to recognize that the surge in inflation is not “transitory”. As a result, global markets have fallen sharply since the start of the new year and seem poised for further declines in the near term.

Figure 1. S&P 500 at Inflection Points – Bull and Bear Markets, 1996 to Date

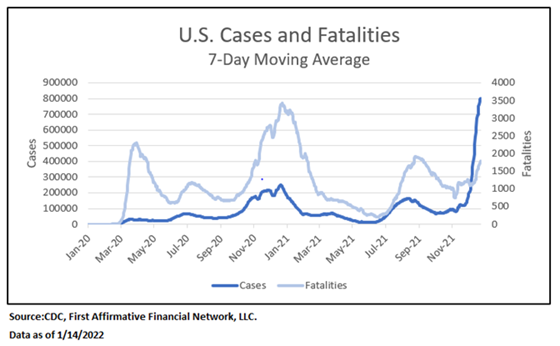

With the emergence of omicron, we face a highly contagious – and hopefully short-lived – variant that impacts the unvaccinated, as well as the “vaccinated and boosted”. As a result, the “pandemic of the unvaccinated” myth has been dispelled and forecasters surveyed by The Wall Street Journal this month have slashed their expectation for growth in the first quarter by more than a percentage point, to a 3% annual rate from their forecast of 4.2% in the October survey. At the same time, inflation hit a 40-year high in the US last month amid labor shortages, kinks in the supply chain, and seven-year high oil prices.

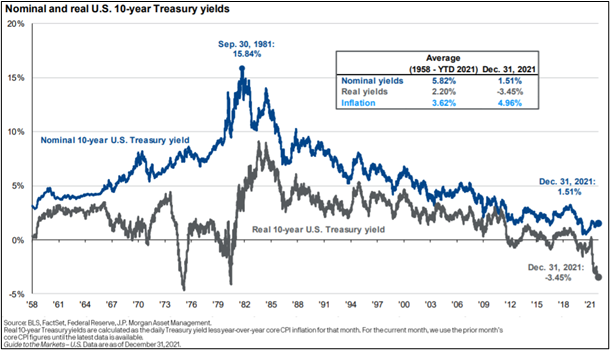

Despite the recent sell-off, financial markets have yet to close the gap between inflation expectations and reality as evidenced by real interest rates at a level last seen in 1981 (see Figure 2 below). Either nominal rates will rise to reflect the surge in inflation, inflation will retreat, or we will see some combination of the two (as we expect). After largely ignoring rapidly rising inflation through 2021, bond yields are surging, indicating a shift in sentiment. Fiscal spending also looks set to moderate following the flood of pandemic-induced spending over the past two years as Washington gridlock persists. Against this backdrop, earnings growth – which was slowing before the emergence of omicron – and interest rates will be the key determinants of stock price performance in 2022, suggesting headwinds ahead for global equity markets.

Figure 2. Nominal and Real 10-Year Treasury Yields, 1958-December 31, 2021

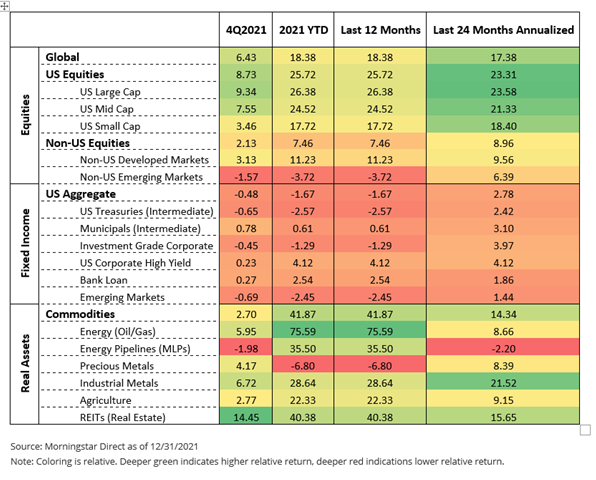

Fourth Quarter Market Review

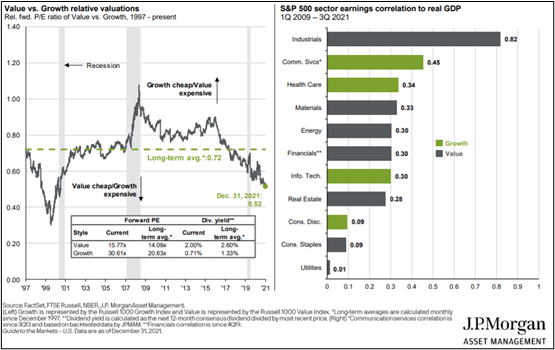

Global equities (MSCI ACWI) advanced 6.7% in the fourth quarter, boosting the return for the year to 18.5% (see Figure 3 below). US stocks (S&P 500 +11.0%) outperformed non-US stocks (MSCI ACWI Ex-USA +1.8%), with emerging markets again lagging developed markets. Large cap stocks outperformed small, and value stocks outperformed growth (see Figure 4 below) in the fourth quarter. The Barclays Aggregate Bond index fell 0.45% in the fourth quarter and 1.29% for the year, and the slide has accelerated year to date in 2022. Finally, commodity prices continued to rise in the fourth quarter — albeit at a slower pace. Energy and Industrial Metals were the stand-out performers during the quarter.

Figure 3. Global Equity, Fixed Income, and Real Assets Performance (Percent Change), 4Q 2021

Figure 4. Morningstar Style Box Analysis, 4Q 2021

Higher commodity prices reflect the acceleration in economic activity, inventory rebuilding, and supply constraints.

The longer-term performance gap, current valuations, and the economic backdrop continue to favor the economically sensitive sectors represented in the value category (see Figure 5 below).

Figure 5. Value versus Growth and Sector Earnings Correlation to Real GDP, 4Q 2021

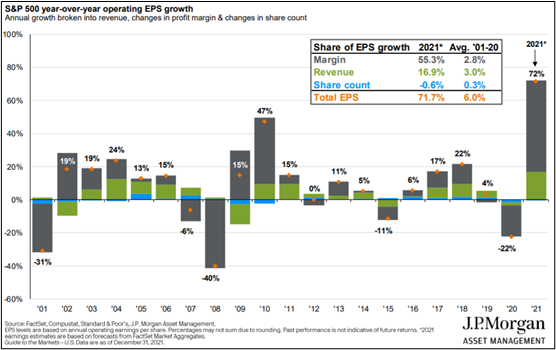

Equity markets are expensive, which is “normal” for this stage of an economic recovery. Corporate profits recovered sharply in 2021, although a deceleration in the rate of growth is evident in the fourth quarter results now being reported. Both revenues and margins expanded rapidly in 2021 (see Figure 6 below). With inflation accelerating pricing power will become increasingly important in 2022. Industries able to pass on raw material and labor cost increases and those able to quickly implement technology changes to improve efficiency will fare far better than those unable to do so.

Outlook – Delayed Recovery and High Inflation to Challenge Markets

The powerful restart of economic activity that was evident pre-omicron has been delayed, but in our view, not derailed. The monetary and fiscal policy actions resulting from the pandemic have set the stage for a different environment than we have seen in quite some time. That environment is likely to be characterized by rising inflation, higher rates, and potentially slower growth. Central banks will start to raise rates soon, but remain more tolerant of inflation, which will settle above pre-Covid trends. The year is off to a rocky start, with a jump in 10-year Treasury yields, a sharp drop in tech shares pulling down stocks, and an even more dramatic fall in crypto and other new high-risk assets. The swoon in traditional assets likely will be short-lived, as omicron runs its course and economic growth resumes.

Figure 6. S&P 500 Earnings Growth, 2001-2021

Following the summer surge, the number of COVID cases fell sharply through early December. Then omicron emerged, it seemed like everyone was getting sick – the vaccinated and boosted, the unvaccinated, and people who were previously infected – and the collective mood shifted from optimism that we were emerging from the pandemic to fear and uncertainty (see Figure 7 below). As we enter year three, we do not know how the post-pandemic world will look, or if a strain more virulent than omicron yet equally contagious and vaccine-resistant is on the horizon.

Investors should remain prepared for choppiness and possible consolidation as we move – likely in “fits and starts” – toward learning to live with COVID and the inflation regime change now underway. Investors who stay the course amid market volatility and conflicting prognostications, maintaining well-diversified portfolios geared toward achieving their long-term objectives, will continue to be rewarded.

Achieving Long-Term Investment and Impact Objectives

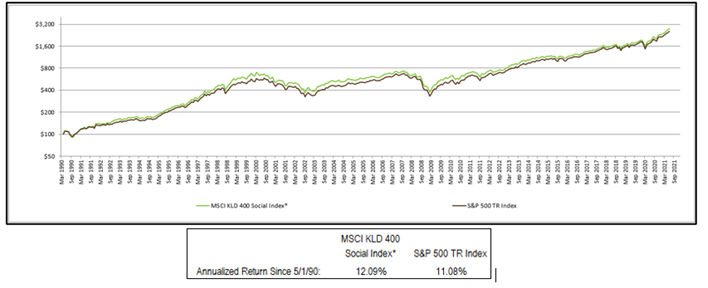

The shift into sustainable, responsible, and impact (SRI) investments continues. According to FastCompany, 2021 was a record year for ESG, with an estimated $120 billion poured into sustainable investments, more than double the $51 billion of 2020. As shown in Figure 8 below, the MSCI KLD 400 index outperformed the S&P 500 index in 2021, as it has over the long term. The sustained, consistent performance of this standard SRI/ESG benchmark over time and recent outperformance support our view that strategies incorporating environmental, social and governance (ESG) factors – with an eye toward making the world a better place – and mainstream financial returns can be achieved simultaneously.

As always, everything we do at First Affirmative is driven by our dedication to enabling advisors to deliver financial results to clients and belief in the power of capital to bring about lasting environmental and social change. Our new, innovative Values-Aligned Direct Index Solution (VADIS) and Sustainable Managed Mutual Fund and Multi-Manager Investment Solutions are built to enable clients to achieve their financial goals over the long term, along with their individual environmental, social, governance, ethical, and values-based objectives. Each portfolio is carefully constructed to be well diversified across assets, sectors, geographies, securities, and management styles –– and designed to weather periods of uncertainty and volatility.

Figure 7. New COVID Cases in the US – Virus Inception to January 14, 2022

Figure 8. MSCI KLD 400 vs S&P 500 Indices, December 31, 2021

Source: Morningstar. *Data prior to 9/1/2010 is that of the MSCI KLD 400 Social Index GR, while data since 9/1/2010 is that of the MSCI KLD 400 Social Index NR. Indexes are unmanaged groups of securities. Index performance does not include the impact of cash, fees, or transaction costs. Investors cannot invest directly in indexes but may purchase mutual funds or other investment products designed to track the performance of various indices.